Mission and ambition of the Research Centre

The ESCP Center for Finance (ECF) is committed to advancing knowledge on how investors, firms, and financial intermediaries—such as banks, mutual funds, and other financial institutions—interact to drive wealth creation and promote sustainable economic growth.

By delivering actionable insights, ECF supports policymakers, businesses, and investors in fostering a financial system that is more efficient, sustainable, and resilient, contributing to long-term economic stability and sustainable wealth generation.

ECF’s research is organized into four key streams:

- Risks, Returns, and Financial Market Dynamics

- Financial Institutions and Their Role in the Market Economy

- Enhancing Firm Value through Corporate Finance and Governance

- Sustainability, Climate, and Financial Markets

Seminars

Our People

Director

Konark Saxena

Director ESCP Center for Finance (ECF)

Konark Saxena is an Associate Professor at ESCP Business School. Konark’s research focuses on various aspects of investing, including portfolio choice, asset pricing, sustainable finance, the asset management industry, and the effects of interest rates and monetary policy on financial decision-making. His work has been published in top-tier finance journals such as The Review of Financial Studies, Journal of Financial Economics, and Journal of Financial and Quantitative Analysis.

Permanent Faculty

Abalfazl Zareei

Associate Professor

Madrid

azareei@escp.eu

Alberta Di Giuli

Professor

Turin

adigiuli@escp.eu

Alessia Menichetti

Professor

Madrid

amenichetti@escp.eu

Axel Buchner

Professor

Berlin

abuchner@escp.eu

Cecile Kharoubi

Professor

Paris

ckharoubi@escp.eu

Christian Mücke

Assistant Professor

Madrid

cmucke@escp.eu

Christophe Moussu

Professor

Paris

moussu@escp.eu

Christophe Thibierge

Associate Professor

Paris

thibierge@escp.eu

Elias Ohneberg

Assistant Professor

Madrid

eohneberg@escp.eu

Francesco Mazzola

Assistant Professor

Turin

fmazzola@escp.eu

Franck Bancel

Professor

Paris

bancel@escp.eu

Houdou Basse Mama

Professor

Berlin

hbassemama@escp.eu

Julien Fouquau

Professor

Paris

jfouquau@escp.eu

Lei Zhao

Associate Professor

Paris

lzhao@escp.eu

Mathis Mörke

Assistant Professor

Paris

mmoerke@escp.eu

Michael Axenrod

Assistant Professor

London

maxenrod@escp.eu

Michael Troege

Professor

Paris

troege@escp.eu

Nabil Kahale

Associate Professor

Paris

nkahale@escp.eu

Nelson Camanho

Associate Professor

London

ncamanho@escp.eu

Panagiotis Dontis Charitos

Associate Professor

London

pdontischaritos@escp.eu

Paul Karehnke

Professor

Paris

pkarehnke@escp.eu

Philippe Thomas

Associate Professor

Paris

pthomas@escp.eu

Pramuan Bunkanwanicha

Professor

Paris

pbunkanwanicha@escp.eu

Roberto Tubaldi

Assistant Professor

Turin

rtubaldi@escp.eu

Santiago Barraza

Associate Professor

Turin

sbarraza@escp.eu

Silvia Dalla Fontana

Assistant Professor

Turin

sdallafontana@escp.eu

Soon Leong

Assistant Professor

London

sleong@escp.eu

Tamara Nefedova

Associate Professor

Paris

tnefedova@escp.eu

Thomas David

Associate Professor

Paris

tdavid@escp.eu

Tina Oreski

Assistant Professor

Turin

toreski@escp.eu

Ulrich Pape

Professor

Berlin

upape@escp.eu

Researchers (PhDs and PostDocs)

- David Germain

- Taline Harissi, Paris

- Khalil-Etienne Janbek, Paris

- Luigi Lannutti

- Rémi Montagu, Paris

- Mikhail Polikarpov, Paris

- Yuwen Qiu, Paris

- Kristine Sahakyan, Paris

- Thi Thuy Trang Truong, Paris

- Newsha Zahabi, Paris

- Hulai Zhang, Paris

Our Research Activities

The Risks, Returns, and Financial Market Dynamics stream investigates the mechanisms underpinning asset pricing, portfolio optimization, and financial market behavior. Leveraging theoretical models, advanced financial econometrics, and data science methods—such as machine learning—this research examines risk premia, momentum, sovereign risk, and derivative pricing, offering insights into investment strategies, asset pricing, and market efficiency.

The Financial Institutions and Their Role in the Market Economy stream examines the impact of financial intermediaries—including banks, mutual funds, and fintech—on economic outcomes. This research explores topics such as bank bailouts, open banking, credit markets, and monetary policy transmission, providing insights into the systemic importance of financial institutions and their regulatory implications.

The Enhancing Firm Value through Corporate Finance and Governance stream explores ownership structures, governance practices, and financing decisions—including private equity, venture capital, and family dynamics—and their impact on firm performance and value creation.

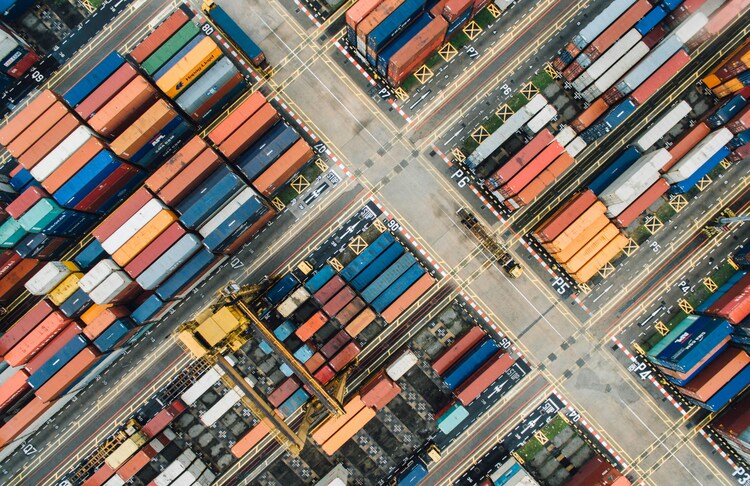

The Sustainability, Climate, and Financial Markets stream investigates the intersection of finance and environmental responsibility, examining how climate agreements, corporate sustainability initiatives, and investor preferences shape financial markets, firm strategies, and the broader transition to a sustainable economy.

Upcoming Conferences and

Workshops

Conferences

Annual Hedge Fund Research Conference

Organized by Tamara Nefedova with Serge Darolles (Paris Dauphine University)

NYU-LawFin/SAFE-ESCP BS Law & Banking/Finance Conference

Organized by Christophe Moussu, Michael Troege, and Thomas David (with Ryan Bubb, Michael Ohlrogge, and Tobias Tröger)

Jointly organized by New York University, ESCP Business School, the Leibniz Institute for Financial Research SAFE and the Center for Advanced Studies on the Foundations of Law and Finance.