Making ESCP's entrepreneurial impact more visible

This article was written by David Nenning and Lukas De La Trobe of the ESCP Alternative Investment Society (AIS).

The ESCP Founder Report 2025 is a consolidated, data-driven overview of ESCP-founded startups that was created by the Alternative Investment Society and the ESCP Blue Factory. It brings together a structured analysis of the school’s entrepreneurial output, including 11 ESCP-founded unicorns and more than $1.1 billion raised by ESCP alumni startups in 2025 alone.

ESCP Business School has long been a breeding ground for entrepreneurs across Europe and beyond. At a time when Europe faces an urgent need for innovation and entrepreneurial spirit, ESCP carries a particular responsibility to embrace its role as one of the continent's leading entrepreneurial business schools.

Not only was the term "entrepreneurship" defined and coined by ESCP co-founder Jean-Baptiste Say, but ESCP alumni have also gone on to found companies that operate at global scale, attract international capital, and shape entire industries.

While this legacy is substantial and internationally diverse, much of ESCP’s entrepreneurial impact has not yet been fully consolidated or presented in a structured, data-driven format. Our student society created the ESCP Founder Report 2025 with the ESCP Blue Factory to capture and further showcase the breadth and depth of entrepreneurship emerging from the ESCP community.

A student-led initiative

The initiative was launched by the Venture Capital department of the Alternative Investment Society (AIS) following a review of comparable founder ecosystem reports published by leading European institutions.

The objective was to develop ESCP's first comprehensive, data-driven founder report: a structured assessment of the school's entrepreneurial output, funding activity, and broader ecosystem impact.

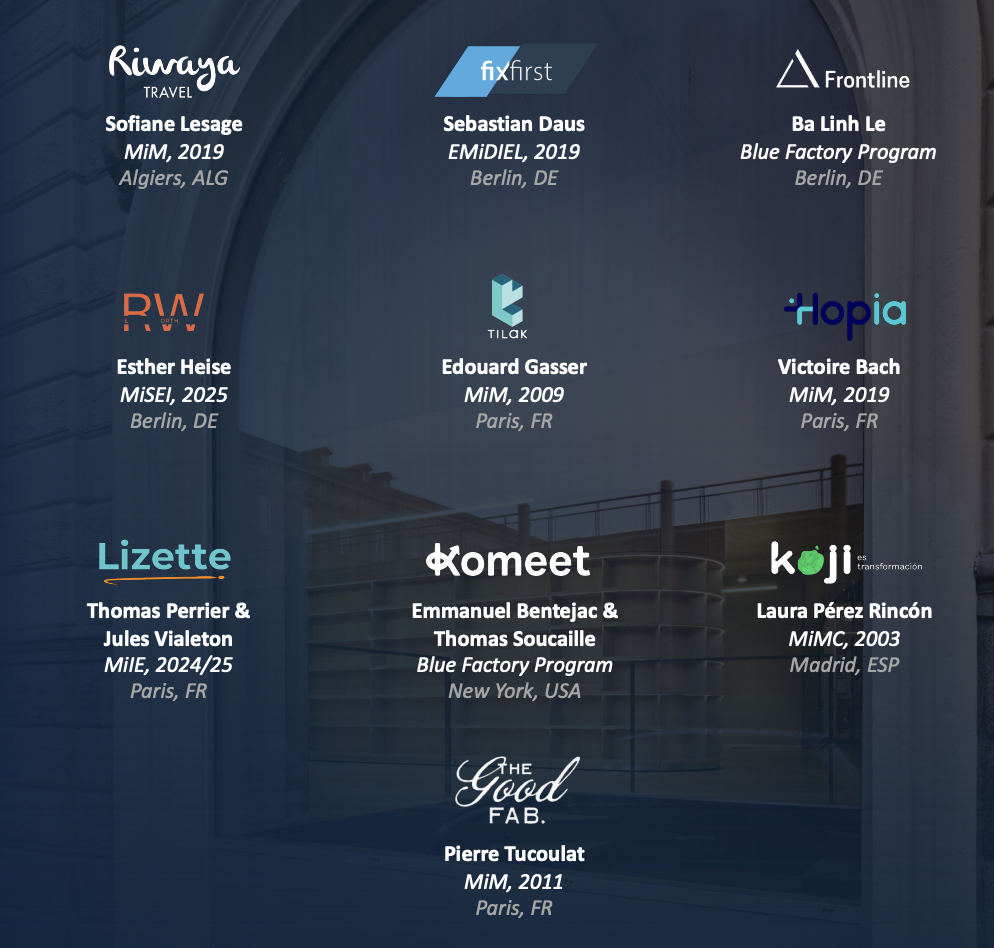

From a student perspective, the report aims to provide tangible role models by highlighting founders who studied at ESCP and share a similar educational and institutional experience. By showcasing their journeys and outcomes, the report offers current and prospective students concrete insights into the entrepreneurial pathways emerging from ESCP, including direct access to job opportunities within ESCP alumni startups.

Starting a career at an ESCP-founded company enables students to learn directly from alumni founders, gain hands-on startup experience, and ultimately build the skills and mindset required to found a company themselves, widely regarded as one of the most effective pathways to successful entrepreneurship.

Strengthening a pan-European founder network

Beyond inspiration, the report is designed to serve as a connective platform between ESCP founders and alumni investors across its multi-campus European footprint. By strengthening ties within the ESCP community, the initiative seeks to reinforce an ecosystem in which founders and investors with a shared institutional background actively support one another in building the next generation of high-impact European companies.

Such founder–investor flywheel effects are foundational pillars of successful venture ecosystems, as demonstrated by dense entrepreneurial networks observed in leading global institutions.

Identifying 11 ESCP-Founded Unicorns

Early-stage research quickly validated our core thesis. While previous public references mentioned six unicorn founders, the independent analysis conducted for this report identified eleven ESCP-founded unicorns.

These companies span multiple sectors, geographies, and graduation cohorts, highlighting the depth and consistency of ESCP's entrepreneurial output over time and underscoring the importance of maintaining an up-to-date and active representation of the ecosystem.

Research approach and institutional collaboration

Following the initial research phase, the student team worked in close coordination with ESCP Blue Factory and ESCP Business School to align methodology and ensure consistency with the broader institutional ecosystem.

Through this collaboration, we established a research pipeline that combined venture database analysis with direct engagement across the ecosystem. Our team conducted extensive outreach to founders and investors and held in-depth interviews to complement quantitative data with first-hand insight.

The report also features conversations with leading investors and founders, offering qualitative insights alongside quantitative analysis.

The ESCP Founder Report 2025 was developed over a four-month research period, from September through January. The work was conducted according to professional research standards, with clear methodology, verified data sources, and multiple validation layers.

2025 fundraising momentum

The report provides a detailed overview of ESCP-linked entrepreneurship, with a particular focus on recent momentum.

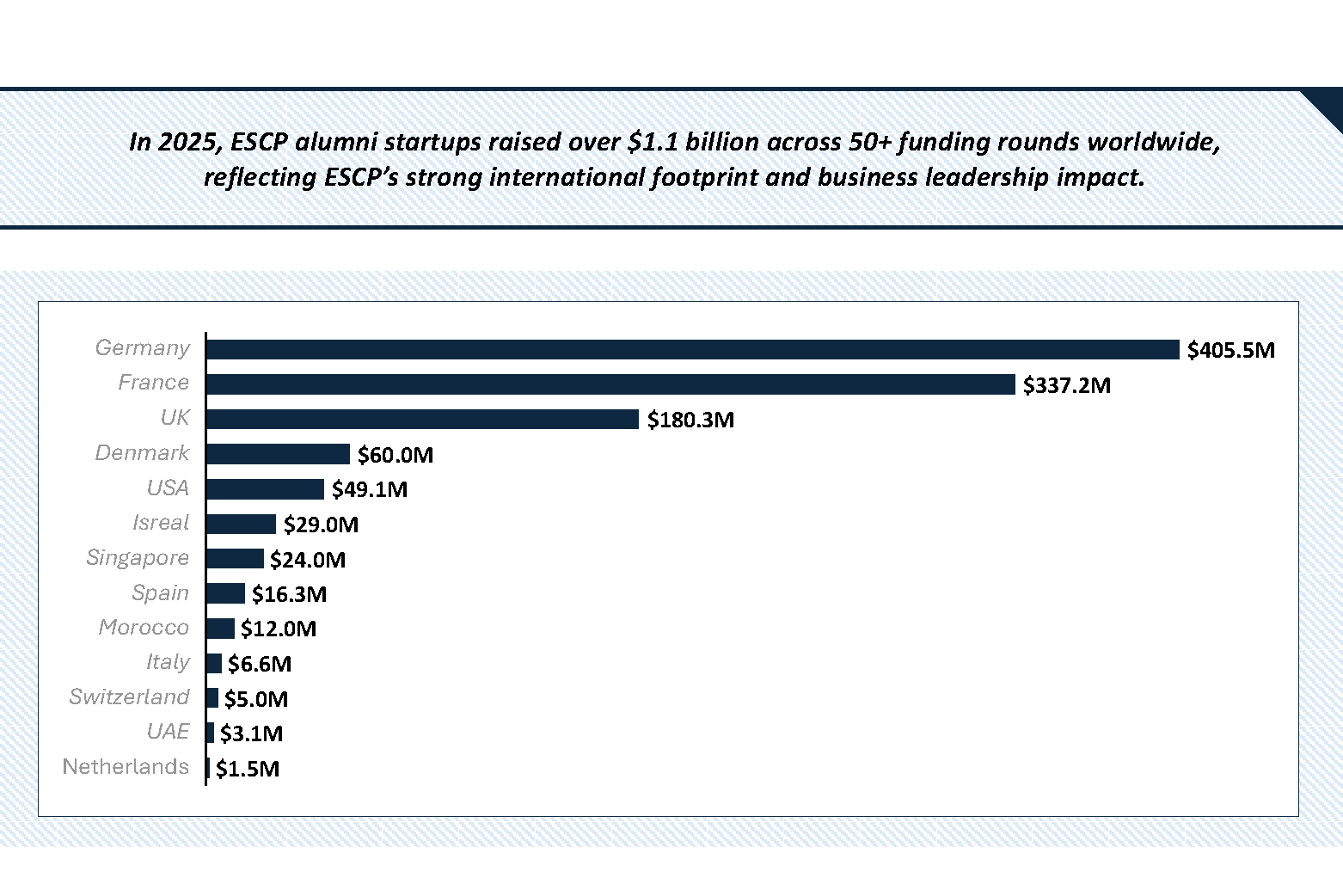

According to our research, in 2025, ESCP alumni startups raised over $1.1 billion across more than 50 funding rounds worldwide, reflecting both the scale and international reach of the ecosystem. Funding activity spans Europe, the United States, and emerging markets, reinforcing ESCP's position as a globally connected founder hub rather than a regionally concentrated one.

In line with ESCP's standards of academic excellence, the report highlights the prestigious investors and significant funding rounds raised by ESCP-founded startups, often strong indicators of product quality, team strength, and execution capability. To reinforce this signal, we deliberately include detailed information on funding round sizes and investor participation, enabling students to better understand what it means to truly excel in the venture landscape.

Beyond funding metrics: the changemakers section

Beyond fundraising metrics, the report intentionally adopts a broader definition of entrepreneurial impact. Venture capital alone does not capture all forms of success.

To address this, the report introduces a dedicated Changemakers section, which highlights founders whose work has generated exceptional economic, social, or political impact, even where venture funding is not the primary indicator. Inclusion in this section is based on external validation such as major awards, public funding, or large-scale institutional recognition.

Looking ahead

The report showcases ESCP's position as a leading European business school with a proven, international founder base and a growing entrepreneurial footprint. The strong engagement from students, founders, and investors following the release confirms the relevance of this work.

Building on this foundation, the Founder Report will continue as a quarterly series, with dedicated Q1, Q2, Q3, and Q4 editions, developed in partnership with ESCP and the ESCP Blue Factory.

Authors

David Nenning

ESCP Alternative Investment Society (AIS)

Lukas De La Trobe

ESCP Alternative Investment Society (AIS)

Campuses